open end mortgage vs heloc

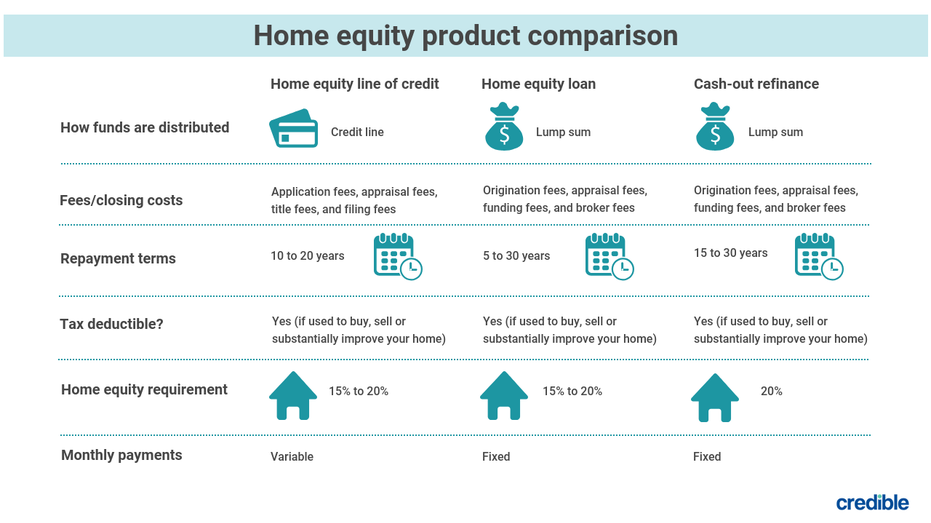

A HELOC is a type of second mortgage that allows you to borrow money against the equity in your home as a line of credit. Unlike a mortgage both open- and closed-ended home equity loans are low-fee transactions.

/shutterstock_188743595.home.equity.loan.cropped-5bfc30d1c9e77c0026b5f52e.jpg)

Home Equity Loan Vs Heloc What S The Difference

Otherwise you will have.

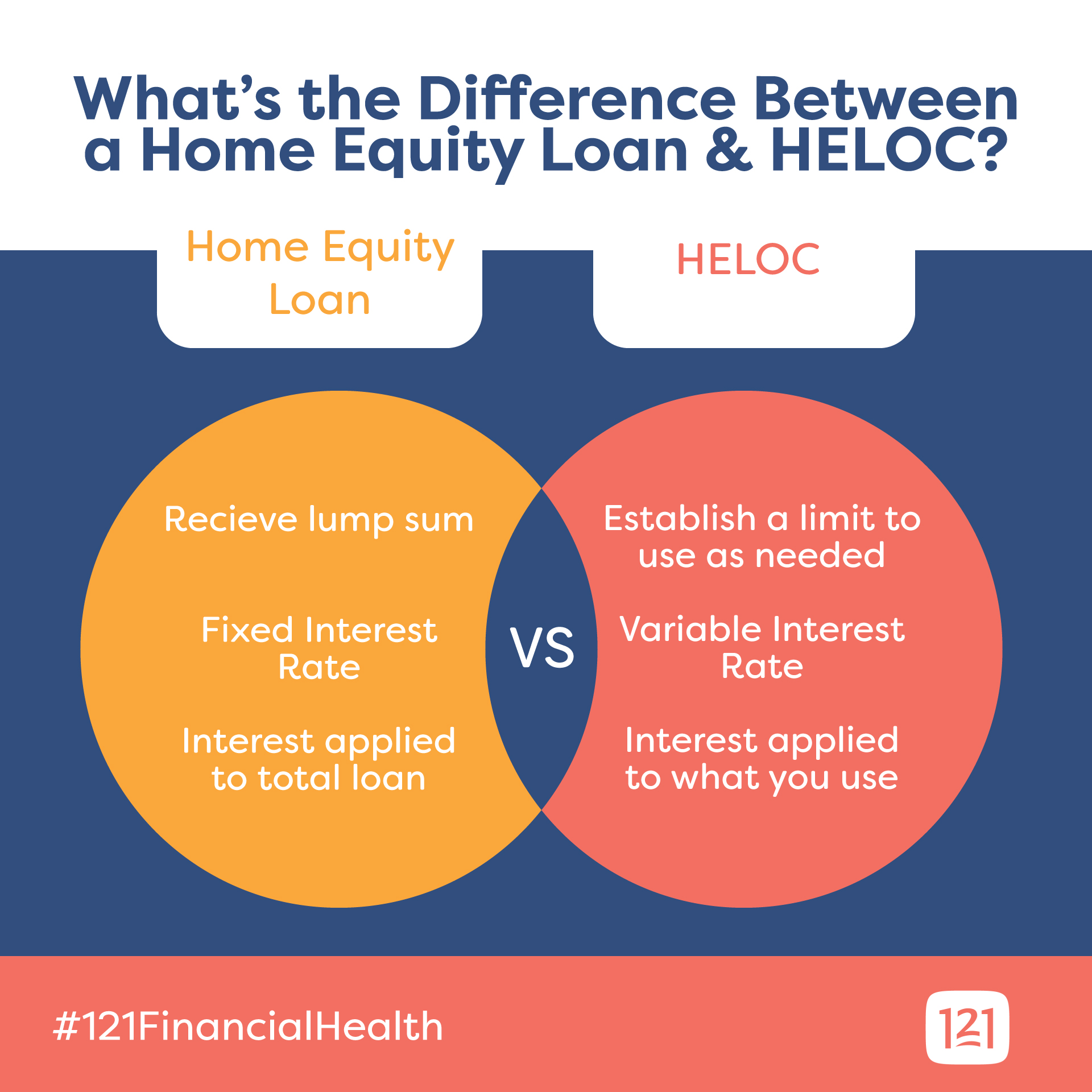

. Now lets look at using a First Lien HELOC and the strategy used to reduce your interest cost. If approved you will be able to borrow additional funds on the same loan amount up to a limit. One key difference between a home equity loan and a traditional mortgage is that the borrower takes out a home equity loan when they already own or have equity in the property.

In the past both types of loans had the same tax benefit. An open-end mortgage allows you to access your home equity and use the funds as necessary. On July 13 2022 Nasdaq reported that the average interest rate for a 10-year HELOC was at a 52-week high of 551 and a 52-week low of 255 percent.

When a home owner applies for an open end mortgage one of the requirements listed on the application form is a pledge of another. A Home Equity Line of Credit is similar to a credit card. It remains open and it.

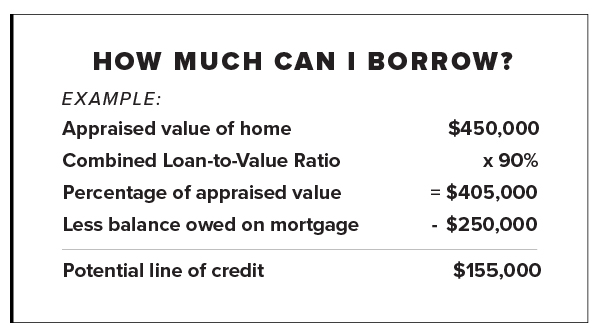

The unused line of credit grows at current expected interest rates. When you take out a HELOC you receive a maximum line of credit that you may access. You borrow money as you need it from an available balance and you only pay interest on the amount you.

Open End Mortgages Vs Collateralized Debt. With a home equity loan the borrower receives the loan proceeds all at once while a HELOC allows a borrower to tap into the line as needed. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related.

Therefore taking a HECM at 62 gives your line of credit time to grow as opposed to waiting until 82 especially if the expected. A second mortgage is paid out in one lump sum at the beginning. Special Offers Just a Click Away.

Using our previous example of a 200000 loan at the same interest. If the terms open end loan and open end mortgage mean the same thing as described in Section 10262a20 then preceding comments apply. For a 20-year HELOC the.

A second mortgage and a home equity line of credit HELOC both use your home as collateral. Find The Best HELOC Mortgage Rates. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

It is important to understand the differences between a mortgage and a home equity loan before you decide which loan you should use. Open-end credit is not restricted to a specific use. Closed-end credit includes debt instruments that are acquired for a particular purpose and a set amount of time.

Choose an open-ended loan when you require a constantly available line of credit for ongoing expenses. Just like other mortgages HELOCs have costs and. Pay for college tuition with an open-ended loan or for long-term medical care.

Unlike other mortgages the HELOC functions like a credit card. 1st Lien HELOC. You can use the equity in your home to pay for whatever.

The line of credit remains open until its. A home equity line of credit HELOC is an open-end line of credit that allows you to borrow repeatedly against your home equity.

Home Equity Line Of Credit Heloc Faq Rate Com

How A Heloc Works Tap Your Home Equity For Cash

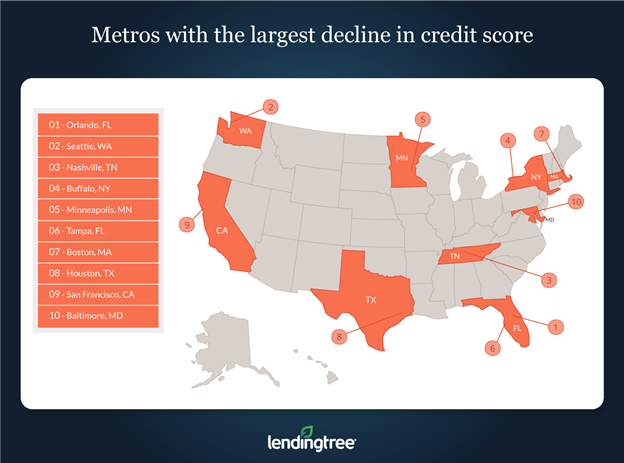

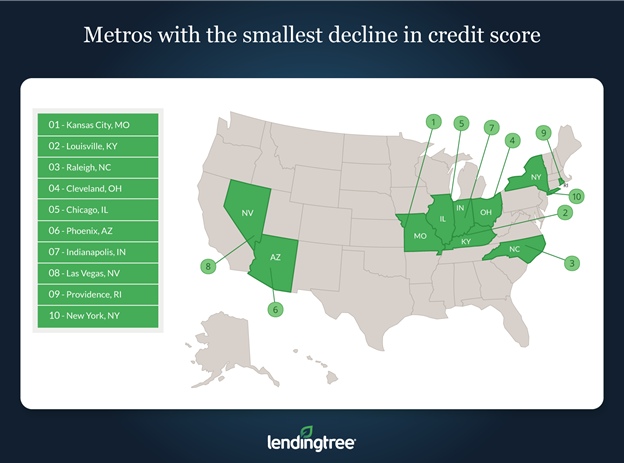

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

Home Equity Line Of Credit Cs Bank Northwest Ar Cassville Mo

Home Equity Loans Vs Home Equity Lines Of Credit Mid Hudson Valley Federal Credit Union

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

Home Mortgage Disclosure Act Faqs Consumer Financial Protection Bureau

Hecm Vs Heloc Comparison Features Decision Guide By Arlo

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)

Home Equity Loan Vs Heloc What S The Difference

Home Equity Line Of Credit Heloc Uccu

Refinance Mortgage In Hawaii American Savings Bank Hawaii

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Home Equity Loan And Heloc Guide Bankrate

Home Equity Line Of Credit Heloc Rocket Mortgage

Heloc What Is A Home Equity Line Of Credit Ramsey

What Is A Home Equity Line Of Credit And How Does It Work Fox Business

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau